Medigap Buyers Top States

Medigap Buyers Top States

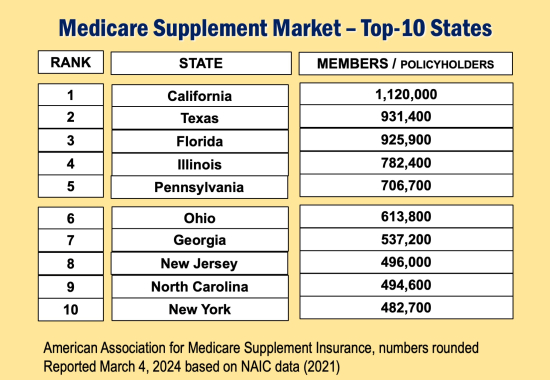

Medigap Buyers Top States – New report shows that California ranks as the state with most seniors covered by Medigap (Medicare Supplement). Just over 14 million Americans have Medigap coverage according to the American Association for Medicare Supplement Insurance. The top-10 states ranked by policyholders are:

- California: 1.12 million

- Texas: 931,400

- Florida: 925,900

- Illinois: 782,400

- Pennsylvania: 706,700

- Ohio: 613,800

- Georgia: 537,200

- New Jersey: 496,000

- North Carolina: 494,600

- New York: 482,700

Medigap coverage, also known as Medicare Supplement Insurance, is a type of private insurance that helps fill the gaps in Original Medicare coverage. Original Medicare, which includes Part A (hospital insurance) and Part B (medical insurance), covers many healthcare services and supplies, but it doesn’t cover everything. Medigap policies are sold by private insurance companies and are designed to help pay for costs that Original Medicare doesn’t cover, such as copayments, coinsurance, and deductibles.

Are Medigap Sales Increasing?

Yes. According to recent data, sales of Medigap policies have been increasing. This trend can be attributed to several factors, including:

Aging Population

The United States is experiencing a significant increase in the number of people reaching retirement age. As the population ages, the demand for healthcare services is also expected to increase. This trend is expected to continue in the coming years, leading to an increase in the demand for Medigap policies.

Rising Healthcare Costs

Healthcare costs in the United States have been rising steadily over the past few decades. As a result, many retirees are finding it difficult to pay for their healthcare expenses. Medigap policies can help alleviate these costs by providing additional coverage for services not covered by Original Medicare.

Increased Awareness

There is growing awareness about the benefits of Medigap policies among retirees. Many individuals are now learning about the importance of having additional coverage to supplement their Original Medicare benefits. This increased awareness has led to an increase in the sales of Medigap policies.

Find Best Medigap Plan G Plans Costs

Costs for Medigap vary significantly. You can pay literally double for the same level or plan of coverage. Check out the 2024 Medigap Plan G Price Index released each year by the American Association for Medicare Supplement Insurance. The repoprt shows the lowest and highest costs for Medigap Plan G in the top-10 U.S. metropolitan areas.

Find the best Medicare drug plans and prices. Plans change each year and Medicare gives seniors the options to compare and switch. Taking a few minutes to compare can save you significant costs each year.