2023 Medigap Turning 65 Plan Choices

2023 Medigap Turning 65 Survey of Buyers

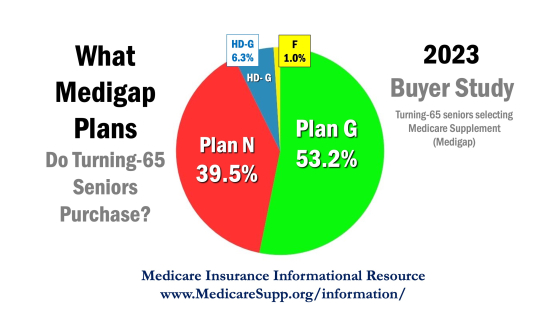

2023 Medigap Turning 65 Statistical Report: The majority of seniors turning age 65 and purchasing Medicare Supplement (Medigap) coverage continue to select Medigap Plan G. The information comes from a new report from the American Association for Medicare Supplement Insurance (AAMSI).

The data was compiled by AAMSI and MedicareFAQ, a leading seller of Medicare insurance solutions.

Medigap Plan G continued to be the number-one Medicare Supplement insurance plan selected by seniors turning age 65 and opting for Medigap coverage. “The popularity of Medigap Plan G can be attributed to its robust benefits, cost-effectiveness, and stability,” explains Jesse Slome, director of AAMSI, the Medicare advocacy organization.

More Than Half Pick Medigap Plan G

According to the analysis, during 2023, over half (53.2%) of the 2,200+ seniors purchased Plan G coverage. The second most popular choice was Medigap Plan N. Some 39.5% of the individuals purchased Medicare Supplement Plan N coverage.

-

- Plan G: 53.2%

- Plan N: 39.5%

- High Deductible Plan G: 6.3%

- Plan F: 1%

2023 Medigap Turning 65 Reasons For Popularity Of Plan G

“One of the primary reasons for the popularity of Medigap Plan G is its comprehensive coverage,” Slome notes. “Medigap Plan G provides coverage for various out-of-pocket costs that are not covered by Original Medicare, including the Part A deductible, Part A coinsurance and hospital costs, Part B coinsurance or copayments.”

While an increasing number of seniors are purchasing Medicare Advantage policies, Medigap has definite benefits experts point out. “Medigap plans offer flexibility in choosing healthcare providers since they are not restricted to networks,” Slome a leading Medicare insurance expert points out. “This benefit allows beneficiaries to see any doctor or specialist who accepts Medicare. Another benefit of Medigap is the ability to travel within the United States and still have coverage.”

According to Slome, with most Medigap plans, beneficiaries have access to coverage for emergency healthcare services when traveling outside their home state. “This can provide peace of mind for individuals who frequently travel or live in multiple locations throughout the year,” he adds.

Medicare Supplement Plan F

While Medicare Supplement Plan F is no longer offered to newly eligible Medicare beneficiaries, the plan can still be available to those who were eligible for Medicare before January 1, 2020, and already had Medigap Plan F or were eligible to purchase it before that date can still keep or buy Medigap Plan F. “This means that if you were already enrolled in Medicare Part A and/or Part B before January 1, 2020, you are still eligible to purchase or keep Medigap Plan F,” Slome explains.

Local Agents Can Help Find Best Medicare Supplement Insurance

A recent report published by the Association revealed important information regarding 2024 costs for Medigap Plan G policies.

Costs vary significantly among insurance companies offering Medigap Plan G. For example, in Houston, a male turning 65 could pay as little as $131.81-per-month for Medigap Plan G. Another insurer charges $279.57-per-month for Plan G coverage to Houston men turning 65.

Find local Medicare insurance agents near me by accessing the Association’s free online directory. Simply enter your Zip Code and see agents listed close to you. Access is free. You do NOT get added to any lists. See agents listed and decide who (if anyone) you want to speak with.