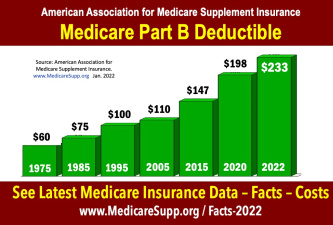

Medicare Part B Deductible from 1975 to 2022

What is the Medicare Part B Deductible. How has the deductible amount changed over the years. Data from 1975 to 2022 showing the trend.

What is the Medicare Part B Deductible. How has the deductible amount changed over the years. Data from 1975 to 2022 showing the trend.

- 1975 – $60

- 1980 – $60

- 1985 – $75

- 1990 – $75

- 1995 – $100

- 2000 – $100

- 2005 – $110

- 2010 – $155

- 2015 – $147

- 2020 – $198

- 2022 – $233

Medicare Part B Deductible – What It Is

Medicare Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. Some people automatically get Medicare Part B (Medical Insurance), and some people need to sign up for Part B

Most people pay the standard Part B premium amount. The 2022 amount is $170.10-per-month. However, if your modified adjusted gross income is above a certain amount, you’ll pay more. That is the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium. IRMAA is based on your IRS tax return from 2 years ago.

Find Best Medicare Insurance Plan Coverage

Click here to access the directory and Find Medicare Advantage Agents

There are countless companies looking to sell you Medicare coverage. Only one resource exclusively lets you find local Medicare insurance agents.

Use the Association’s directory for a listing. Access is 100% free and 100% private. Just enter your Zip Code.

Type your Zip Code into the banner on the right. or click the link.

Access 2022 Medicare insurance statistics.

What Does Part B Cover?

Part B covers 2 types of services

- Medically necessary services: This includes services or supplies that are needed to diagnose or treat your medical condition. And, they meet accepted standards of medical practice.

- Preventive services: These are defined by Medicare as health care to prevent illness (like the flu). Or medical services to detect it at an early stage, when treatment is most likely to work best.

You pay nothing for most preventive services if you get the services from a health care provider who accepts the Medicare assignment.

Medicare Part B Deductible Amounts 1975 – 2017

| YEAR | Amount | % Increase |

| 1975 | $60 | 0% |

| 1976 | $60 | 0% |

| 1977 | $60 | 0% |

| 1978 | $60 | 0% |

| 1979 | $60 | 0% |

| 1980 | $60 | 0% |

| 1981 | $60 | 0% |

| 1982 | $75 | 25% |

| 1983 | $75 | 0% |

| 1984 | $75 | 0% |

| 1985 | $75 | 0% |

| 1986 | $75 | 0% |

| 1987 | $75 | 0% |

| 1988 | $75 | 0% |

| 1989 | $75 | 0% |

| 1990 | $75 | 0% |

| 1991 | $100 | 33% |

| 1992 | $100 | 0% |

| 1993 | $100 | 0% |

| 1994 | $100 | 0% |

| 1995 | $100 | 0% |

| 1996 | $100 | 0% |

| 1997 | $100 | 0% |

| 1998 | $100 | 0% |

| 1999 | $100 | 0% |

| 2000 | $100 | 0% |

| 2001 | $100 | 0% |

| 2002 | $100 | 0% |

| 2003 | $100 | 0% |

| 2004 | $100 | 0% |

| 2005 | $110 | 10% |

| 2006 | $124 | 13% |

| 2007 | $131 | 6% |

| 2008 | $135 | 3% |

| 2009 | $135 | 0% |

| 2010 | $155 | 15% |

| 2011 | $162 | 5% |

| 2012 | $140 | -14% |

| 2013 | $147 | 5% |

| 2014 | $147 | 0% |

| 2015 | $147 | 0% |

| 2016 | $166 | 13% |

| 2017 | $169 | 2% |

Read Tips for Consumers on Medicare

What Medicare.gov fails to tell you.

Medicare Plan G Costs – Price Index (2021)