Medicare Insurance Facts Data and Statistics - 2021

Medicare Insurance Data Statistics 2021

Medicare Insurance Data Statistics 2021

This Medicare insurance data resource page provides pertinent information for consumers and insurance professionals compiled by the American Association for Medicare Supplement Insurance. Material may be shared and used. We would greatly appreciate credit to the “American Association for Medicare Supplement Insurance” with links back to this webpage. Thank you.

NEW: 2021 Medicare Advantage Statistics

Medicare Insurance Data Statistics – 2020

Medicare insurance data links. Click to jump directly to the information.

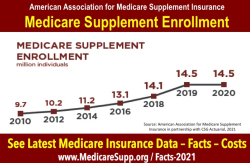

- Medicare Supplement Owners – 2010-2020

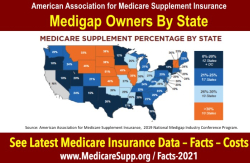

- Medicare Supplement Owners – By State

- Less Than 50% Compare Medicare Plan Options Annually

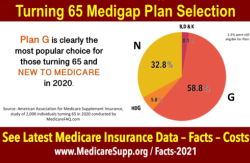

- Post 2020 Medicare Supplement Plan Choice

- 2020 Turning 65 Buyer Data: Plans G and N Top Choices

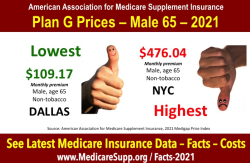

- 2021 Medicare Supplement Plan G Prices – Male Age 65

- 2021 Medicare Supplement Plan G Prices – Female Age 65

- 2021 Medicare Supplement Plan N Prices – Male Age 65

- 2021 Medicare Supplement Plan N Prices – Female Age 65

- 20 Medicare Supplement Insurance Companies Competing In Typical Market

- Top 20 Medicare Supplement Insurance Companies (2020)

- Medicare Supplement – Ages of Medigap Policy Owners

- Med Supplement – Income of Medigap Policy Owners

- Medicare Advantage – 2020 Plans Available in US

Medicare Supplement Owners; 2010 – 2020

The number of Americans with Medicare Supplement (Medigap) insurance has been increasingly steadily but has held steady most recently. Source: American Association for Medicare Supplement Insurance (AAMSI), 2021, in partnership with CSG Actuarial.

The number of Americans with Medicare Supplement (Medigap) insurance has been increasingly steadily but has held steady most recently. Source: American Association for Medicare Supplement Insurance (AAMSI), 2021, in partnership with CSG Actuarial.

Medicare Supplement – Medigap Plan Ownership By State

Medicare Supplement – Medigap Plan Ownership By State

Medicare Supplement (Medigap) insurance ownership varies by state. The Association attributes this to the fact that in many larger metropolitan areas, there are more Medicare Advantage choices available. Source: American Association for Medicare Supplement Insurance (AAMSI), 2019 National Medicare Supplement industry conference program.

Less Than Half Compare Medicare Plan Options Yearly

Less Than Half Compare Medicare Plan Options Yearly

Only 57% of Medicare beneficiaries review or compare their Medicare plan coverage options annually. The ability to switch Medicare plans – Medicare Advantage and Medicare Prescription Drug Plan coverage is a singular benefit overlooked by consumers reports the American Association for Medicare Supplement Insurance.

Medicare Supplement – What Medigap Plans People Choose

Medicare Supplement – What Medigap Plans People Choose

The vast majority of new buyers are selecting Medigap Plan G. Previously, Plan F was the top choice of new buyers and ongoing policyholders. However Plans C and F are no longer available to NEW buyers. Current owners can maintain them. Source: American Association for Medicare Supplement Insurance (AAMSI), 2021 report

2020 Turning 65 Buyer Data: Plans G and N Top Choices

2020 Turning 65 Buyer Data: Plans G and N Top Choices

More than half (58.8%) of seniors turning 65 purchased Medigap Plan G. 32.8% chose Plan N. Plans B, D and K account for 0.1%. High Deductible Plan G; 5.8%. For those turning 65 who already had Medicare Supplement Plan F, they could continue with that plan (2.5%). Source: American Association for Medicare Supplement Insurance (AAMSI), 2021 report, April 15, 2021

2021 Plan G Prices – Male Turning 65 – Lowest & Highest

2021 Plan G Prices – Male Turning 65 – Lowest & Highest

The cost of Medicare Supplement insurance varies dramatically based on where you live. To see the 2021 Medigap Plan G Price Index showing rates for top-10 metro areas, click the highlighted link. Source: American Association for Medicare Supplement Insurance (AAMSI), 2021 Medigap Price Index

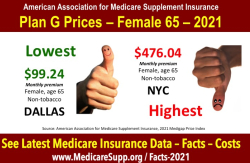

2021 Plan G Prices – Female Turning 65 – Lowest & Highest

2021 Plan G Prices – Female Turning 65 – Lowest & Highest

Women turning age 65 generally can pay less for Medigap insurance. See the 2021 Medigap Plan G Price Index (click the highlighted link). Source: American Association for Medicare Supplement Insurance (AAMSI), 2021 Medigap Price Index

2021 Plan N Prices – Male Turning 65 – Lowest & Highest

2021 Plan N Prices – Male Turning 65 – Lowest & Highest

FOR MEN – In every metro area, there is a wide spread between the lowest available price and the highest price. Lowest price for a male was in Dallas ($77.19-per-month). Highest was in Phoenix $33.38. See the 2021 Medicare Plan N Price Index data (click the highlighted link). Source: American Association for Medicare Supplement Insurance (AAMSI), 2021 Medigap Price Index IMAGE SHOWN: PLAN N – CHICAGO, IL

2021 Plan N Prices – Female Turning 65 – Lowest & Highest

2021 Plan N Prices – Female Turning 65 – Lowest & Highest

FOR WOMEN – Lowest Medigap Plan N prices for a woman turning 65 was $77.19 (Dallas) and $82.79 (Washington, D.C.). Highest prices were $292.34 (Phoenix) and $282.05 (Manhattan, NY). See the Medicare Plan N 2021 Price Index (click the highlighted link). Source: American Association for Medicare Supplement Insurance (AAMSI), 2021 Medigap Price Index IMAGE SHOWN: PLAN N – PHOENIX, AZ

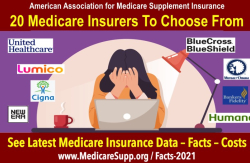

20 Medicare Supplement Insurance Companies Competing

20 Medicare Supplement Insurance Companies Competing

Association analysis of major U.S. metro areas finds there are an average of 20 different insurance companies offering Medicare Supplement insurance (Plan G). Ranges from low of 5 (Manhattan, NYC) to over 20 in cities (Atlanta, Chicago, Phoenix, Houston).

See Medicare choices news item. Source: American Association for Medicare Supplement Insurance (AAMSI), 2021 Medigap Market Analysis

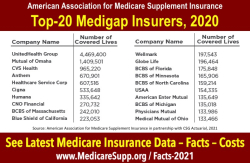

Top-20 Medicare Supplement Insurance Companies (2020)

Top-20 Medicare Supplement Insurance Companies (2020)

The chart shows the top-20 Medicare Supplement insurance companies based on the number of policies (2020). The chart doesn’t show for the three New Era Life companies (Number of covered lives: 120,689 / Premium: $270M).

To see a larger image of the chart click this link: 2020 Top Medicare Supplement Insurance companies

2021 Medigap Age of Medicare Supplement Policy Owners

For women, the cost of Medicare Supplement insurance varies dramatically across the U.S. No one insurer was always the cheapest and none was always the most costly. See the 2021 Medigap Plan G Price Index (click the link). Source: American Association for Medicare Supplement Insurance (AAMSI), 2021 Medigap Price Index

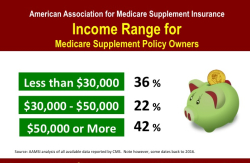

Medicare Supplement – Income Distribution of Policy Owners

Medicare Supplement – Income Distribution of Policy Owners

Most owners of Medicare Supplement insurance policies have annual incomes of $30,000 or more. Nearly half (42%) have incomes of $50,000 or more. Source: American Association for Medicare Supplement Insurance (AAMSI) analysis of CMS data

Medicare Advantage – 2020 Plans Available In the US

There are 100 different Medicare Advantage plans available in the United States (in 2020). Thirteen (13) plans became available for the first time in 2020. One (1) plan exited the market in 2020. Source: Kaiser Family Foundation

Medicare insurance data or statistics 2021 Not Found Here? Reporters and editors. You can call or Email us and we will work to get the data you are seeking. Phone Jesse Slome at 818-597-3205.

Looking for Long Term Care Insurance statistics and facts. Visit our sister organization.