What's Medigap - Medicare Supplement insurance that fills gaps in Original Medicare

What’s Medigap?

Medicare Supplement insurance is often referred to as Medigap (or Med Supp). This coverage provided by some 40-to-50 different insurance companies fills in the “gaps” in Original Medicare. Original Medicare (Parts A & B) pays for much of the cost for covered medical and health care needs. But it does not cover everything.

Medicare Supplement insurance is often referred to as Medigap (or Med Supp). This coverage provided by some 40-to-50 different insurance companies fills in the “gaps” in Original Medicare. Original Medicare (Parts A & B) pays for much of the cost for covered medical and health care needs. But it does not cover everything.

That’s why some 14 million Americans have purchased Medigap coverage (2021).

10 Things To Know About Medigap

- You must have Medicare Part A and Part B

- Med Supp is different from Medicare Advantage

- Policies are offered by private insurance companies.

- Plans are identified with letters (except in a few States)

- Pricing for plans can vary significantly among insurers

- Plans sold after January 1, 2006 can’t include prescription drug coverage

- You pay the private insurance company in addition to Part B premium paid to Medicare

- New Medicare enrollees can no longer purchase Plans C or F

- Coverage may cover medical costs when you travel outside the U.S.

- Changing from one Med Supp plan to another can have limitations

Medicare Supplement 2021 Price Index

Costs for Medigap insurance vary significantly from one insurance company to the next. While plans are basically identical (one Plan G is the same as another Plan G), here’s what you should know.

- Rates vary significantly among insurers.

- No insurer always had the LOWEST rate.

- Neither was one always the MOST COSTLY.

- Some insurers add fees (not shown as premium cost).

- Discounts may be offered to couples and partners.

- These can reduce your cost by up to 14%.

Plan G costs reported by the Medicare Supplement 2021 Price Index.

Medicare Supplement Plan N Med Supp Price Index for top metro areas.

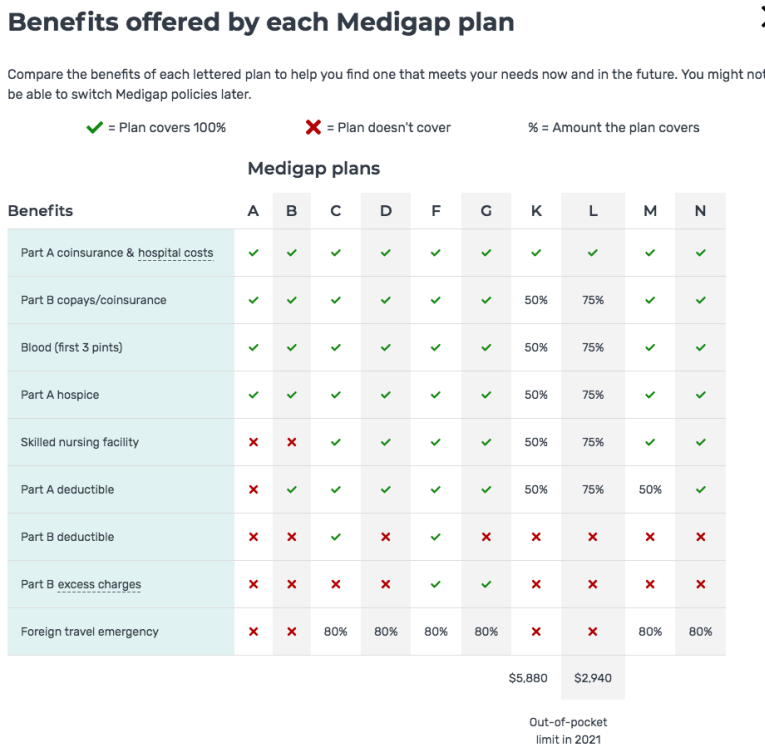

Medicare Supplement Benefits By Plan

7 Things To Know About Medigap

- A policy is different from a Medicare Advantage Plan and new policies do not cover prescription drugs. Medicare Advantage (MA) plans bundle your Hospital (Part A), Medical (Part B), and usually drug coverage (Part D) into one plan. In addition, today, many MA plans also offer extra benefits that Medicare doesn’t cover. These include vision, hearing, dental benefits. However, it’s important to really look closely at these benefits to see if they offer any real value.

- Medicare first pays its share of the approved service. Then your Medigap policy helps pay your covered share. You can’t get a Medigap policy if you have a Medicare Advantage Plan, unless you switch back to Original Medicare

- You need both Medicare Part A and Part B to buy and keep a policy.

- The best time to get a policy is during your Open Enrollment Period. That’s the 6-month period that starts the month you turn 65. Don’t forget that you will need to have both Medicare Part A and Part B. During this time, you can buy any Medigap policy sold in your state, even if you have health problems.

- After your Open Enrollment Period ends, you may not be able to buy a policy. If you’re able to health qualify, you may be able to buy one. But expect it to cost more. There are some special protections that can vary by State. It pays to work with a knowledgeable specialist who can explain the rules and help you.

- There are 10 standardized plans. Each plan offers different levels for how much of your costs they’ll pay for. They’re named by letter, like Plan A, and Plan B. Not all plans are offered in every state. If you live in Massachusetts, Minnesota, or Wisconsin, your state offers different standardized plans.

- You’ll keep your policy. It can not be cancelled by the insurance company even if you have health problems as long as you pay your policy and Part B premiums.