Find Best New York Medicare Insurance Plan - Directory Lists NY Medicare Agents

New York Medicare Costs vary significantly. According to the 2022 Price Index for Medicare Supplement (Medigap) insurance policies, the following are costs for Plan G coverage for a man or woman age 65. Costs shown are for five leading insurance companies.

- $278.25-per-month

- 289.75-per-month

- $390.00-per-month

- 398.38-per-month

- $476.04-per-month

Why Pay Almost $200 More Monthly for Identical Coverage?

There is no reason to pay more. Medicare mandates what benefits insurance companies must include. Some may offer a few nominal added benefits (like gym memberships). But basically all policies with the same letter (Plan G) are identical.

A local Medicare insurance agent should be able to help you compare available plans.

Click this link to access the Association’s directory of independent Medicare insurance brokers.

Here are some questions to ask when interviewing an agent or broker.

- How long have you been selling Medicare insurance?

- Are you appointed with multiple Medicare insurance companies? How many?

- Do you sell BOTH Medicare Supplement and Medicare Advantage coverage?

New York Medicare Costs

Why does one company offer Medicare Supplement Plan G for $278.25 a month? Is there something wrong with a company that is charging $476.04 monthly?

The answer is somewhat complex. Each insurance company gets to decide what they charge for Medicare Supplement insurance. Medicare Supplement is also often called Medigap.

Insurance companies can change their rates each year. For that reason, you should ask the agent for a history of insurance company rate increases.

But the bottom line is that each insurance company get to decide what they want to charge. They look at their claims experience. Then they predict future trends and care needs.

It is up to you, the consumer to compare, and to make your best decision.

Find Best New York Medicare Costs

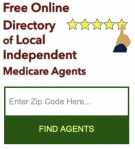

Use the Association’s free directory to find local Medicare insurance agents.

Enter your Zip Code.

Click the Find Agents tab.

A listing of local agents will appear instantly.

You pick who you want to call or Email (if any of them).

Additional Sources of Information

Latest Medicare insurance statistics for 2022

Tips to save on Medicare costs