To find an experienced Medicare broker in your area start by asking whether they offer Medicare Advantage and Medigap plans and how many insurance companies they are ‘appointed’ with. Ask these 7 questions to insurance brokers selling Medicare solutions.

To find an experienced Medicare broker in your area start by asking whether they offer Medicare Advantage and Medigap plans and how many insurance companies they are ‘appointed’ with. Ask these 7 questions to insurance brokers selling Medicare solutions.

- How many years have you sold Medicare insurance?

- Do you offer both Medicare Advantage and Medicare Supplement?

- How many Medicare insurance companies are you appointed with?

- Can you help me pick a Medicare drug plan?

- Do you meet face-to-face or sell over the phone and Internet?

- If I have questions after signing up, do you help clients?

- Do you track rate increases for Medicare insurance plans?

Why A Medicare broker in your area can benefit you?

Medicare is a national program. But Medicare plans are local in nature. They are often County specific.

Here’s how working with a Medicare broker in your area can benefit you:

- An experienced Medicare broker will know which plans are available locally.

- They will have heard from upset seniors about plans that make them unhappy.

- When plans change (and they do) they will likely know.

- Companies can raise rates. Good agents track rate increase history.

- Many brokers are on Medicare themselves. They will have done their homework before buying.

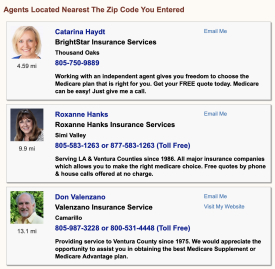

Find A Local Medicare Broker

The Association’s website makes available the nation’s leading directory of local Medicare agents and brokers.

It is free to access. It’s 100% private. All you enter is your Zip Code.

You’ll see their complete information. Do they sell Medicare Advantage and Medigap.

You choose who you want to call or E-mail (if anyone).

Click the link to access the directory. Find a Medicare broker in my area.

What Is A Broker?

Many people never heard the phrase ‘insurance broker‘. People tend to call them insurance agents. But there is a difference between agents and brokers.

An insurance broker represents people searching for insurance plan coverage. A broker can sell policies from several different insurance companies for a commission.

Insurance agents typically “represent” one insurance company.

Ask this simple question to determine if the person you are speaking with is a broker or an agent. “How many different insurance companies are you appointed with?”

Appointed is insurance industry jargon. It means the individual is able to sell that company’s policy and earn a commission.

Are Medicare Brokers Appointed With All Insurers?

Probably not. But they don’t need to be. There may be 20 different insurance companies selling Medicare Supplement in the area where you live.

A broker will generally pick say 5 or 6 insurance companies that they believe are best for the majority of people. Thus, they can only offer those to you.

That’s why you should also ask the Medicare broker what insurance companies they are appointed with. If they are missing one you’ve heard about, ask them why. And, it may pay to find a broker offering that plan so that you can compare.

Do They Offer Both Medicare Advantage and Medigap?

Some do. But not all. There are pros and cons for both types of Medicare plans.

If you are turning 65, you really should compare both. Because while some Medicare plans allow you to freely change, that is NOT universally true.

Some brokers will only offer Medicare Supplement (Medigap) because there are few good Medicare Advantage plans available where you live.

Others will offer both. This is especially true in areas where more people favor Medicare Advantage. That’s generally true for major urban areas.

How do Medicare brokers get paid?

Brokers only get paid a commission from the insurance company. The commission is built into the cost of the policy.

They can’t offer you a better price. The Federal government and the State Department of Insurance regulate insurance policy pricing.

So, yes, they are working for free until you buy something. You are getting their expertise for free (they, of course, hope you will buy from them).

If the broker is independent, they pay their own expenses. Some brokers work in call centers and other offices. They generally earn a lower commission. But their expenses are covered.

Do all insurance companies pay the same?

Generally they pay about the same. But that will vary. A broker should never base their recommendation on the commission.

Could it happen? Yes. That’s why it’s important to be an educated buyer and compare – compare – compare.

Medicare broker in my area – Access the Directory

Only the Association’s directory helps you exclusively find a local Medicare broker in my area.

Other websites want your personal information. Some sell your information to others (sometimes many others).

We do not ask for your information. Access is 100% private. And that’s a huge difference and advantage to you.

After you enter your Zip Code, you will instantly see the listing of Medicare brokers near you.

Access the Medicare Agent directory now.

Other Medicare Resources for Consumers

Access the latest Medicare insurance statistics.

Read tips to find the best Medicare drug plan coverage.