IRMAA Matters For Higher Income Seniors on Medicare - Ways To Save!

What is IRMAA for Medicare? The income-related monthly adjustment amount (IRMAA) is the amount set by the federal government that determines how much you will pay monthly for Medicare Part B and Part D prescription drug coverage. It is a sliding scale SURCHARGE based on the modified adjusted gross income (MAGI) from prior tax filings. Higher income seniors can pay over $5,000 more yearly because of the IRMAA surcharge.

What is IRMAA for Medicare? The income-related monthly adjustment amount (IRMAA) is the amount set by the federal government that determines how much you will pay monthly for Medicare Part B and Part D prescription drug coverage. It is a sliding scale SURCHARGE based on the modified adjusted gross income (MAGI) from prior tax filings. Higher income seniors can pay over $5,000 more yearly because of the IRMAA surcharge.

This article shares how IRMAA is calculated and share some tips that can help you reducing the IRMAA Surcharge amount in future years.

10 Facts About The IRMAA Surcharge

- IRMAA is a surcharge that higher income Medicare beneficiaries pay each month.

- This year’s tax filing can help you reduce future IRMAA surcharges.

- The amount is typically deducted from monthly Social Security payments.

- 2007 was the first year IRMAA for Medicare Part B began.

- Your 2023 IRMAA is based on your 2021 Federal tax filing.

- The Medicare Part B standard monthly premium is $164.90 (2023).

- The 2023 IRMAA surcharge for Part B can cost $395.60 monthly ($4,747.20).

- The monthly surcharge for Medicare Part D ranges from $0 to $76.40.

- IRMAA surcharges have grown steadily. Increases have ranged from 4.73% to 8.02%.

- Life changing events can help you request reconsideration of IRMAA surcharges.

2022 Tax Filing: Read Before You Submit Your 2022 IRS Taxes

Click to read some 2022 IRMAA tax tips. Your 2022 Modified Adjusted Gross Income (MAGI) will determine your IRMAA surcharges for 2024. We share 2022 MAGI level numbers to watch for!

This information is provided as general information to help seniors better understand the topic. We do NOT give TAX or FINANCIAL advice. For that you should speak to your CPA, tax preparer or financial advisor.

What Is IRMAA for Medicare?

IRMAA stands for Income-Related Monthly Adjusted Amount. It’s a surcharge (increase in the monthly Medicare premium for Parts B and D).

The amount is determined by the Social Security Administration. If you get Social Security benefits, your Medicare premium and any IRMAA surcharge is deducted from your monthly Social Security payment.

IRMAA was initially enacted in 2003 as a part of the Medicare Modernization Act. The surcharges for Medicare Part B went into effect in 2007. The IRMAA for Part D was implemented as part of the Affordable Care Act in 2011.

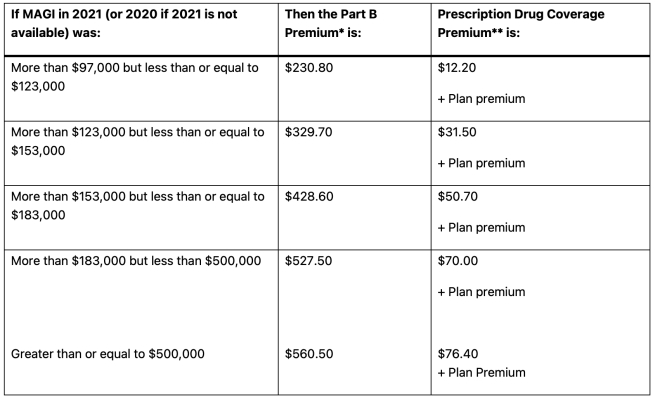

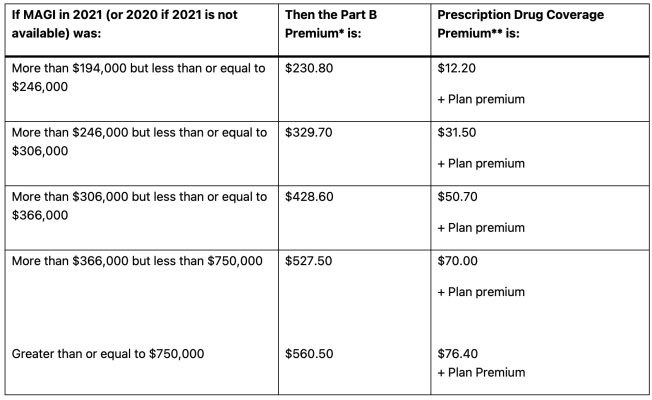

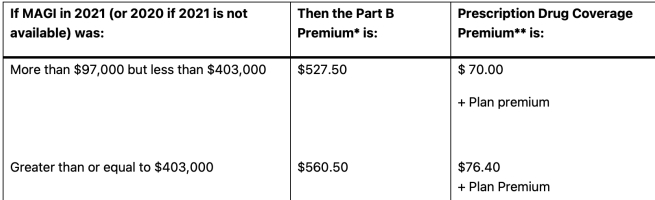

The 2023 IRMAA Surcharge Brackets

Single, head–of–household, or qualifying widow(er) with dependent child tax filing status

Surcharge added when income is over the amounts shown (lefthand column)

Married filing jointly tax filing status

Married filing separately tax filing status

Links to Social Security Administration IRMAA 2023 charts.

Reducing Future IRMAA for Medicare Surcharges – 2022 & 2023 Taxes

This is where things get tricky. But, by falling $10 over the bracket threshold level … you could face paying $2,000 or more in annual Medicare premiums.

Take a married senior couple whose MAGI in 2021 was $306,200 (just $200 over the 2023 IRMAA threshold). Each spouse faces paying $98.90 MORE MONTHLY in Medicare Part B and $19,20 MORE MONTHLY in Part D premiums. That’s $2,834.40 MORE COMBINED ANNUALLY for the couple.

If they had reduced their MAGI by $201 they would have saved themselves $2,834.40! That’s why it makes thinking about IRMAA worthwhile.

LOOKING AHEAD: Looking ahead is, of course, tricky. You have to try to control your CURRENT taxes – while predicting the future MAGI levels (2 years from now). IRMAA amounts 2 years from now will be based on how much inflation we’ve had.

But here are some thoughts (remember, we do not give tax advice!).

Before Filing Your 2022 Federal Taxes

2024 IRMAA levels will be based on your 2022 tax filings. It pays to check to see how close you are to possibly being kicked into the next bracket.

If you are close to one the current bracket amounts (or our examples of future growth) it can be worth doing the following;

1. Calculate what you think the bracket level will be in 2 years (2024 level guestimates shown in bold).

2. Check to see if there are still ways to avoid landing in the next MAGI threshold.

Here are the numbers we suggest watching out for. The first number is the current IRMAA Surcharge Thresholds (2023). The number in brackets are 2024 projections based on 1 year of inflation growth annualized at 6.0%.

Single (tax filers):

$97,000 ($103,000)

$123,000 ($130,500)

$153,000 ($162,000)

$183,000 ($194,000)

$500,000 ($530,000)

Couples filing jointly (tax filers):

$194,000 ($206,000)

$246,000 ($261,000)

$306,000 ($324,500)

$366,000 ($388,000)

$750,000 ($795,000)

Remember: MAGI is adjusted gross income (AGI) plus these, if any: untaxed foreign income, non-taxable Social Security benefits, and tax-exempt interest. For many people, MAGI is identical or very close to adjusted gross income. MAGI doesn’t include Supplemental Security Income (SSI).

Tax filing software (such as TurboTax) doesn’t automatically calculate. But they can show you how to do it (so they claim online).

Tax Strategies To Reduce Your Modified Adjusted Gross Income

Once again, we do not give tax information. There is a lot of good information that you can find online. Here are some topics to look into. And, of course, always discuss them with your CPA, whoever files your taxes and a tax professional. He or she will know exactly what counts towards MAGI. It is different than your “Adjusted Gross Income”.

- Tax Deductible Retirement Plan Contributions. If you have earned income, you can make tax-deductible contributions to a retirement account. These include a traditional or SEP IRA, a 401k or a solo 401k.

- Focus on Tax Free Income. By withdrawing money from tax-free sources, you can keep your taxable income low and reduce IRMAA. Strategies suggested online include Roth IRAs, reverse mortgages and even certain types of permanent life insurance.

- Consider Your Retirement Withdrawal Strategies. This is a complex topic and one that you really need to discuss with a financial professional.

- Charitable Giving. If you are charitably inclined, there are multiple strategies to support causes you care about while make IRMAA-reducing donations.

Keep in mind that you are looking ahead, typically 2 years. So, with the exception of an IRA contribution where you have until April 15th (of the next year) to make contributions, these strategies likely won’t do anything in the near term.

But, IF your financial advisor doesn’t bring them up … YOU SHOULD!

Ways To Appeal IRMAA for Medicare in 2023

The Social Security Administration defines life changing events. If you’ve experienced one and you are subject to IRMAA in 2023, you can request to have your IRMAA surcharge reconsidered.

Here are the IRMAA life changing events :

- Marriage

- Divorce, or the annulment of a marriage

- Death of a spouse

- Work stoppage or reduction

- Loss of income-producing property for reasons beyond the beneficiary’s control

- Loss or reduction of pension income due to a plan failure, termination, or cessation of benefits

- Employer settlement payment resulting from an employer’s (or former employer’s)

bankruptcy, closure or reorganization

In addition, you can appeal if you think incorrect data was used to calculate the IRMAA surcharge. There are, however, important deadlines.

You can start the process by calling Social Security at 800-772-1213. You will ultimately need to submit Form SSA-44.

Links To Other Helpful Information

Find the best Medicare drug plan options.

2023 Medicare Advantage statistics.

Best Medigap Prices for 2023.