Medicare Drug Plan Compare For 1-1-2024

Here’s why every senior on Medicare should compare their drug plan yearly during Medicare Open Enrollment.

- In 2022 prices for 3,000 drugs increased. They will likely increase again.

- The typical increase was 10%.

- 23 million seniors with Medicare Part D drug plans can freely switch.

- The typical senior who switches Part D coverage saves between $500 and $700.

- Costs for Part D plans range from under $5-per-month to over $60-per-month.

- The best plan for you will depend on what drugs you take.

- Open Enrollment begins October 15.

- Your free opportunity to switch ends on December 7.

Inflation and a New Law Impacts Medicare Drug Costs & Plans

BAD NEWS FOR SENIORS: The inflationary impact of pharmaceutical pricing is expected to be in the high single or double digits from 2023-24. Expect costs for your plan to increase starting January 1, 2024.

GOOD NEWS FOR SENIORS: President Biden signed into law the Inflation Reduction Act of 2022. Because this law includes several provisions to lower prescription drug costs, seniors with Medicare stand to benefit. There are also provisions that impact Medicare drug plans. The first provisions take effect beginning in 2023. But many will begin in subsequent years.

For all these reasons, it’s smart to review your drug plan coverage for 2024 before the December 7th deadline.

How to Find Your Best Medicare Drug Plan Option

Depending on where you live, you could have just a few Medicare drug plans available. But, most seniors will have between 20 and 30 different Medicare Part D plans to choose from.

Part D plans change each year on January 1st. That is why it is important to compare every year. Medicare allows you to change plan coverage for the coming year.

Finding your best coverage can be simple. The first step is gathering the names and dosages of the different drugs you take. Write them down or have the different jars nearby.

If you work with a local Medicare insurance agent, definitely ask if they are able to run a drug plan comparison for you. Some will. Others may just be too busy during Medicare Open Enrollment.

To find a local Medicare agent, simply type your Zip Code into the box to the right. No other personal information is needed to access the Association’s online directory of Medicare insurance agents.

DO IT YOURSELF MEDICARE DRUG PLAN COMPARISON MADE EASY! The Association makes available an online drug comparison tool. It’s free to use. Best of all (we think) is the fact that NO PERSONAL INFORMATION is required to use the tool.

DO IT YOURSELF MEDICARE DRUG PLAN COMPARISON MADE EASY! The Association makes available an online drug comparison tool. It’s free to use. Best of all (we think) is the fact that NO PERSONAL INFORMATION is required to use the tool.

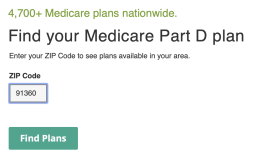

Simply enter your Zip Code to start. (Begin this when Open Enrollment begins after Oct. 15).

The system will show you plans available in your Zip Code.

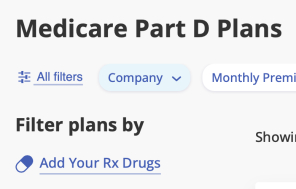

TO FIND YOUR BEST PLAN OPTION look for the link that allows you to Add Your Rx Drugs.

It’s on the left near the top of the page.

Here’s where you’ll enter the drugs you take. The name and the dosage (example 10 mg once a day).

Using this information, you can see exactly what you should expect to pay in 2024.

IF YOU WANT YOU CAN APPLY for the plan online. But, you do NOT have to.

Things To Know About Medicare Part D Drug Plans For 2024

Switching During Medicare Open Enrollment – You can switch from your current plan during Open Enrollment. December 7th is the FINAL day to make a change.

Your New Plan Coverage Will Begin January 1, 2024.

What If You Change Your Mind? You can change plans as many times as you need during Medicare’s Fall Open Enrollment. It is your last choice takes effect January 1. That said, it is usually a good idea to make as few changes as possible.

You Don’t Need To Disenroll From Your Current Plan. Enrolling in a new drug plan during the Medicare Open Enrollment period will disenroll you from your previous plan. You do not need to contact the previous plan to drop that coverage. It’s a good idea to notify the pharmacy where you fill your prescriptions so they can update their records with your new plan information.

You May Be Eligible For Help To Pay for your Medicare Part D prescription drug costs based on your income and resources. This is known as the federal Extra Help program or the Low-Income Subsidy (LIS). Information is available by contacting the Social Security Administration at 1-800-772-1213.

Additional Resources for Consumers

Find local Medicare insurance agents near me.

Medicare insurance statistics.

Medigap Plan G Price Index – lowest and highest premiums for major U.S. markets.