Medigap plans are the choice of 14.6 million Americans with Plan G being the favorite among men and women turning age 65. But other Medigap options are worth considering and comparing prices for identical coverage can save you significant amounts of money. Here are ways to find the best Medigap plans:

Medigap plans are the choice of 14.6 million Americans with Plan G being the favorite among men and women turning age 65. But other Medigap options are worth considering and comparing prices for identical coverage can save you significant amounts of money. Here are ways to find the best Medigap plans:

- Analyze the popular plans to find the best coverage.

- Find out how many Medigap plans are available for your Zip Code.

- Ask the insurance agent for the names of Medigap insurers they represent.

- See if plans like High Deductible G are available in your area.

- Ask which plans offer spousal or partner discounts.

- Find a Medicare Supplement insurance broker.

Compare Medigap Plans With A Local Medicare Agent

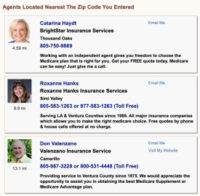

Use the Association’s directory to see a listing of local Medicare agents near you. Access is free and NO personal information is entered to access the directory.

Simply enter your Zip Code.

You will see their info. Call or email whoever you choose.

Click the link to contact Medigap agents near me.

Top Medigap Insurance Companies

There are numerous larger and smaller insurance companies offering Medicare Supplement (Medigap) plans. Size is important. But it doesn’t mean they have the best coverage or the best price. Here are some of the names (listed alphabetically):

- Aetna

- Bankers Fidelity

- Blue Cross / Blue Shield

- Cigna

- Humana

- Manhattan Life Assurance

- Medico Life and Health

- Mutual of Omaha

- New Era Life

- Union Security

- UnitedHealthcare (AARP)

Prices For Plan G Vary (2022 Price Index)

For men and women signing up for Medicare, Plan G is the most popular choice. While all Plan Gs are basically identical, the costs can vary significantly.

Here are prices for Medigap Plan G for Chicago (Zip Code 60611). Costs are monthly for a female, age 65 (non-smoker).

Lowest: $109.87

Highest: $246.79

Other Plans Can Help You Save

Many people are looking at Medigap Plan N and High Deductible G. They offer many of the same benefits but have important differences. It’s worth discussing them when you explore plans with a Medicare insurance agent.

Here are prices for Medigap Plan N for Chicago (Zip Code 60611). Costs are monthly for a female, age 65 (non-smoker).

Lowest: $80.83

Highest: $219.74

For High Deductible Plan G (Chicago, Zip Code 60611) monthly costs are:

Lowest: $32.00

Highest: $68.37

Companies May Offer Spousal Discounts

This is an important thing to look for; spousal or partner discounts. Some companies do not offer any discounts but others do.

The savings may not benefit the first spouse signing up. But when the second spouse becomes Medicare eligible, the savings can add up. Some discounts can be as much as 14-to-15 percent of the monthly premium.

Medigap Can Cover International Healthcare Expenses

The government’s website for Medicare reports that some Medigap (Medicare Supplement) plans will cover your health care expenses while you are outside of the United States.

However, plans won’t generally cover the following:

- Long-term care

- Vision care

- Dental care

- Hearing aids

- Eyeglasses

- Private, at-home nursing

Other Medicare Insurance Resources

See Medicare Plan G Price Index (Plan G) for top-10 U.S. cities.

Read tips to find the best Medicare drug plan.

Best source for Medicare insurance data and statistics.