UnitedHealthcare - Humana - CVS Aetna Are The Top Medicare Advantage (Part C) Plans

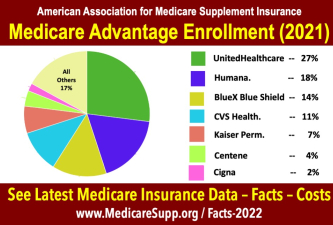

What are the top Medicare Advantage plans most purchased by seniors? Some 24 million Americans chose a Medicare Advantage plan in 2021. UnitedHealthcare (AARP) was the number one choice by far. Here’s a breakdown of what people selected:

- UnitedHealthcare (AARP) – 27%

- Humana – 18%

- Blue Cross/Blue Shield – 14%

- CVS Health (Aetna) – 11%

- Kaiser Permanente – 7%

- Centene – 4%

- Cigna – 2%

- All others – 17%

Local Medicare Agents Can Help You Compare Plans

Medicare is a NATIONAL program. But many times, the plan coverage can be very LOCAL.

In most states, you will have anywhere from 20-to-40 different plans to compare. And that’s only the available Medicare Advantage plans . There may be Medicare Supplement (Medigap) plans that are better suited to your individual needs.

The American Association makes available a national online directory listing LOCAL MEDICARE AGENTS.

Good agents will know the various options available locally.

They’ll know which plans other seniors in your area are SATISFIED WITH. And which they are UNHAPPY WITH.

You can click the link to access the directory. Click this link to see Medicare Advantage Agents Near Me.

It’s 100% FREE. And, 100% Private. You only enter your ZIP CODE.

A Few Things To Know About Medicare Part C (Advantage)

When you select a Medicare Advantage plan (also called Medicare Part C) here’s what happens.

A private company will handle your benefits and claims. They do this instead of the federal government. A Part C plan must cover at least as much as Medicare. That is, unless you go out of the approved plan network.

There are multiple versions of Medicare Advantage programs (plans). There can be very significant differences.

There are Health Maintenance Organization (HMO) policies. With a plan like this, expect to pay 100% of out of pocket costs when you see a doctor or receive care outside of the approved (included) network.

There are also Preferred Provider Organization plans (PPO). Here you’ll want to very clearly understand the rules. For example, in some coverage. In some cases, you may pay as much as 40% of the cost out of the network.

Confused yet? Because it’s complex, we do suggest speaking with a knowledgeable professional.

But let’s continue. There are also Health Maintenance Organization Point of Service policies. These allow you to see some doctors out of network but at a higher rate.

Also available are Private Fee for Service policies. These could require that you call the doctor before services are provided. And, you might have to do this EVERY time before an appointment.

Finally, for low-income individuals or those with or chronic issues ask about Medicare Advantage Special Needs plans. These can be of enormous value.

Medicare Advantage Statistics

Access latest Medicare Advantage statistics

Medicare Part C Open Enrollment

You can sign up for a MA plan during your Initial Coverage Enrollment Period.

If you missed doing that (or you want to change your mind) you want to watch for Medicare’s Annual Enrollment Period.

The Annual Enrollment Period (AEP) happens October 15th-December 7th of each year. During AEP, you can enroll in an Advantage plan with a start date of January 1st.

You can also use this enrollment window to disenroll from your Medicare Advantage plan and switch back to Original Medicare (Parts A & B).

After you disenroll from your Advantage plan, you can choose to pick up a Medigap plan and a stand-alone Part D drug plan.

If you miss the Annual Enrollment Period, your next chance to make changes is during the Open Enrollment Period.