Medicare Supplement Insurance Rate Increases Vary According To New Analysis

Find An Agent

Search your ZIP code to find trusted Medicare agents near you.

Trusted by Thousands of Seniors Nationwide

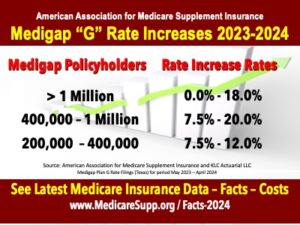

June 20, 2024 – NEW REPORT – MEDIGAP RATE INCREASES. Among the industry leaders, insurers with a million or more Medicare Supplement policies in-force may implement larger rate increases than those with under 400,000 policies-in-force according to a new analysis conducted for the American Association for Medicare Supplement Insurance by Ken Clark, KLC Actuarial.

“One of the most important things to consider when selecting a Medicare Supplement (Medigap) plan is the likelihood of future rate increases,” explains Jesse Slome, director of the American Association for Medicare Supplement Insurance (AAMSI). “Insurers can and do typically increase Medigap rates each year and you aren’t always guaranteed the ability to switch from one insurer to another following a rate increase.”

According to the analysis, half of all Medicare Supplement companies implemented double-digit rate increases for their Medigap Plan G policies from May 2023 through April 2024. “We specifically analyzed rate filings for Texas which is both large and representative of the nationwide regulatory environment,” explains Ken Clark, president of KLC Actuarial LLC, a Chicago-based actuarial firm specializing in Medicare Supplement insurance.

Year-over-year rate increases for companies with one million or more Medigap members ranged from 0.0% to as much as 18%. For companies with between 400,000 and one million members rate increases ranged from 7.5% to 20.0%.

Medigap insurers with fewer policyholders, those with between 200,000 and 400,000 members, reported rate increases of between 7.5% and 12.0%.

“Medigap rates are not guaranteed, something few seniors are aware of or think about when picking a carrier,” notes AAMSI’s Slome. “There can be a host of reasons that a company offers low rates for seniors turning age 65. That low-rate provider may be your best choice or it could be a very costly choice since you are likely to have Medigap coverage for many years, possibly decades.”

“Promoting plans with extremely low rates for seniors turning age 65 without a cautionary warning about future rate increases can really impact people,” says KLC Actuarial’s Clark. “Professional Medicare insurance agents can and should provide information detailing an insurer’s recent history of rate increases,” adds Slome.

“When comparing Medigap plans in 2024, a senior can have anywhere from 4 to 20 different plans and insurers available,” Slome explains. “Getting information and comparison shopping is the only way to get the best information. The insurance agent you speak with may only represent one particular plan. Even if they can sell plans from multiple insurers, it’s not likely they can represent all of them.”

The American Association for Medicare Supplement Insurance advocates for the importance of consumer awareness and supports insurance and financial professionals who market Medicare insurance solutions. The organization provides a national free online directory listing local Medigap agents by Zip Code.

Our Agents Represent