Medicare Tips from the Nation’s Top Medicare Agents

The following tips are shared by leading Medicare insurance experts. Medicare can be confusing. We want to address some points many people are not aware of. Here are 10 tips and important things to think about:

The following tips are shared by leading Medicare insurance experts. Medicare can be confusing. We want to address some points many people are not aware of. Here are 10 tips and important things to think about:

- Options and prices vary, start comparing early.

- Ask for the history of rate increases.

- Planning to move or have two houses?

- Are you planning to travel?

- What’s the best drug plan coverage?

- Medigap discounts can range from 3% to 14%.

- Free preventive screenings.

- Maximize your Health Savings Account.

- Anticipate changes and know what’s possible.

- Timing matters more than you know.

Options Vary – So Do Prices – Free May Actually Cost More

Are you confused already? Medicare can be confusing because there are so many options. And while you think you can change plans down the road, it may not always be possible to get what you want. Zero Plan Cost (often a Medicare Advantage plan) sounds great but they may have a high deductible. A long hospitalization might actually cost you more than a plan where you pay monthly premiums. Medicare Supplement insurance plan premiums can range significantly. In fact we post the LOWEST and the HIGHEST Medigap Plan G pricing for U.S. cities. Just click the link to see.

TIP: START YOUR PLANNING EARLY (at least 3 months before turning 65) and compare on your own or working with someone who can compare with you.

Ask for the Insurance Company’s History of Rate Increases

This is especially important when considering Medicare Supplement insurance (Medigap). Your rate today can change in the future. That’s why it’s important to ask the following two questions. How long has the insurance company been offering Medicare Supplement insurance? And, can you provide me with their history of rate increases.

TIP: A KNOWLEDGEABLE MEDICARE INSURANCE AGENT WILL BE ABLE TO SHARE BOTH pieces of this important information. BONUS TIP. Ask for insurance company ratings (an indication of company strength).

Planning To Move … or Have Two Houses?

Your Medicare choices have immediate impact on your healthcare options. But you really need to think ahead. After retirement many people move. Sometimes to a less costly location. Even a nearby move to the next county (not countRy) can impact your coverage. Other times to be closer to adult children and grandchildren. Maybe you’ll divide your time between two locations. This is especially important because you want your Medicare coverage choices to be suitable TODAY and meet your FUTURE NEEDS.

TIP: BEFORE YOU SIGN ON THE DOTTED LINE think where you might be living five years from now. Make sure the coverage you choose now will be suitable if you are living somewhere else.

Are You Planning To Travel?

One day we will all be traveling again. Many of us will again travel internationally. The Medicare insurance choices you make need to take this into consideration. Medicare Advantage plans in particular have limitations when it comes to coverage outside of the immediate service area. If you do travel (or hope to) be sure to very clearly understand what is covered and the limits of what you are selecting.

TIP: ASK ABOUT SPECIFIC EXAMPLES OF TRAVEL COVERAGE for things like cruises outside of U.S. waters and emergency treatment both within the United States and if you travel abroad.

What’s The Best Drug Plan Coverage?

The cost of drugs is a big matter for many seniors. That’s why choosing the right Medicare prescription drug plan for seniors matters so much. Over 80 percent of Americans over age 65 take at least two prescription drugs and over 50 percent take four or more. About one-quarter (23 percent) of those surveyed by AARP did not fill a prescription they were given within the last two years. Over 55 percent of those reported that cost contributed to the decision not to obtain the medication.

TIP: A GOOD MEDICARE AGENT WILL HAVE ACCESS TO SYSTEMS THAT CAN FIND YOUR BEST DRUG PLAN OPTIONS based on the drugs you currently are prescribed. The least expensive plan may NOT be your best option. Ask them when you can switch plans and don’t wait until the last minute to do this.

Medigap Household Discounts Can Truly Add Up

Some Medicare Supplement (Medigap) insurance companies offer household discounts. The Association has found that they range from a low of three percent to as high as 14 percent. That could save a couple anywhere from $200 to $700 a year.

TIP: ASK IF HOUSEHOLD DISCOUNTS ARE AVAILABLE and what the rules are?

Take Advantage of Free Preventive Screenings

Free is always good and that’s especially true when it can give you peace of mind and better health. Medicare has a long list of rules pertaining to preventative screens ranging from the Welcome to Medicare Screening to breast cancer and prostate cancer screenings, You can go to the Medicare website to see the list and see what is covered for free.

TIP: READ WHAT’S COVERED UNDER THE ‘WELCOME TO MEDICARE’ SCREENING to make sure you get the full benefit of this free benefit. BONUS TIP: Make sure you take advantage of the Welcome Screening during the year when you are age 65.

Maximize Your Health Savings Account (HSA)

When you reach age 65, your HSA eligibility will change due to Medicare, as will the rules for withdrawing funds. Your options actually expand for using the money that you have saved in the account. You can use your HSA funds tax and penalty-free to pay premiums for Medicare.

TIP: IT PAYS TO TAP HEALTH SAVINGS ACCOUNT BALANCES ASSETS EARLIER. As one ages (age 70, 75, etc.) retirement income declines and the likelihood of medical (health care) expenses increase. That potentially could yield you a tax-deductible advantage.

Anticipate Changes And Know What Your Options Are

By the time you reach Medicare eligibility (age 65) you know that things change. Health care providers merge and some go out of business. Companies close down … doctors retire. Medicare rules change. Plans that existed last year are no longer available for those just turning 65. While no one can plan for every contingency, know that there are many rules that pertain to Medicare plans. When change occurs, make sure you work with someone who really understand all your available options.

TIP: MEDICARE RULES CAN VARY BY STATE so when changes occur make certain you consult with someone experienced and fully knowledgeable about your State’s rules.

Timing Matters More Than You Think

Procrastination doesn’t pay. First Medicare has some hard and fast rules regarding timing. There are no exceptions. And consider this. Every day 11,000 Americans turn 65. There are not enough Medicare insurance agents available to help everyone waiting for the last minute. This is especially true during Medicare’s Annual (Open) Enrollment Period (AEP).

TIP: START YOUR PLANNING AT LEAST 60 DAYS IN ADVANCE OF THE FINAL DEADLINE and locking in an appointment on the calendar earlier is even better.

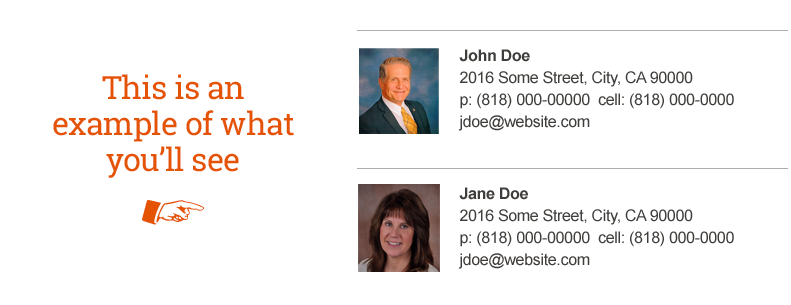

You See Them – No One SEES You!

No Personal Information Required To

Access The Directory.

NO Obligation - NO Data Collected