Find The Best Medigap Plan N - Save Significantly When You Compare

To find the lowest cost Medigap Plan N coverage it is valuable to compare. Prices for identical coverage can vary significantly. Here are the lowest monthly costs according to the American Association for Medicare Supplement Insurance 2023 Price Index.

- Dallas: Female ($77.19) – Male ($87.23)

- Chicago: Female ($83.17) – Male ($96.54)

- Phoenix: Female ($88.96) – Male ($93.67)

- Atlanta: Female ($85.50) – Male ($96.62)

- New York: Female ($215.25) – Male ($215.25)

5 Tips To Find Lowest Cost Medigap Plan N

- Compare plans from multiple insurers.

- Ask about available future discounts.

- Inquire how many years the company has sold Medigap.

- Check out the company’s history of rate increases.

- Speak to at least 1 local Medigap insurance agent.

Why You Should Speak To A Local Medicare Insurance Agent

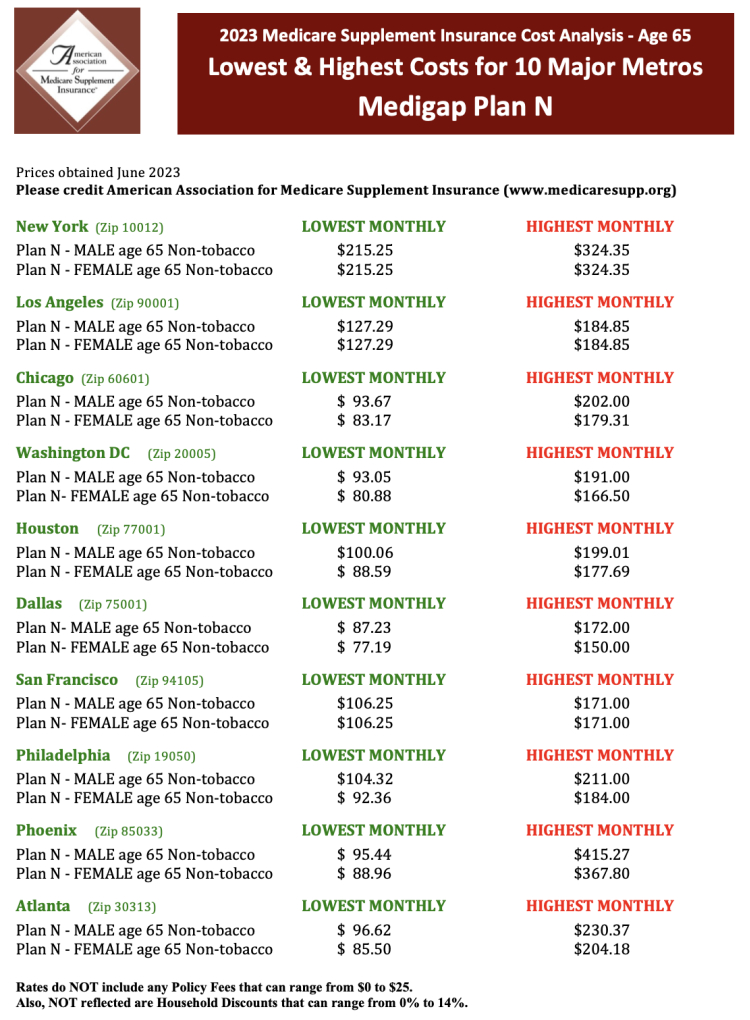

Medicare is a national program. But plan options are based on where you live. All Plan Ns are the same. Not true for the prices you’ll pay. Check out the data below that shows the lowest and highest prices for 2023 in 10 major metropolitan areas.

A local Medigap insurance agent typically knows more about what’s available locally. Use the Association’s free online directory to find agents in your area. Enter your Zip Code in the box on the right. No personal information is needed to see the directory listing.

Highest and Lowest Cost Medigap Plan N Premiums (2023)

If you are turning age 65 in New York City would you rather pay $215.25 monthly or $324.35? Pick the right Medigap Plan N company and you’ll save $109 each month. Save $1,308 in your first year.

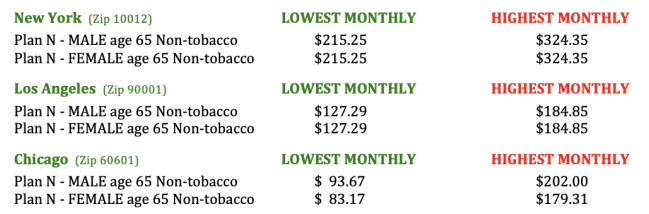

The following shares the lowest and highest costs for New York, Los Angeles and Chicago. Below we show the full report for 10 top metro areas.

Plan N 2023 Price Index Highlights

Plan N is the #2 most popular choice among women and men turning 65 and opting for Medicare Supplement (Medigap). Here are a few key findings from the Plan N 2023 Price Index.

- Prices varied significantly (even more than prior year).

- Consumers had between 6 and 20 different insurers available.

- No insurer was always the least expensive.

- Neither was one insurer always the most costly.

- Some insurers add a policy fee. The fee can be $25.

- Discounts available ranged from 0 to 14%.

Use These Tips To Find Lowest Cost Medigap Plan N

Compare plans from multiple insurers. Only insurance agents can sell Medigap insurance. Call what appears to be an insurance company and you’ll actually be speaking to an insurance agent. Ask how many insurance companies they are appointed with. That will tell you whether they are only selling plans from one company (or more).

Ask about available future discounts. Many insurers offer discounts when both spouses have coverage. Save as much as 14 percent! Few couples both turn 65 together. Ask about available discounts and the rules that apply when you both are Medicare eligible.

Inquire how many years the company has sold Medigap. Ask if the lowest priced company has just started selling. See if you can switch to another insurer if they raise rates in future years. Ask what limits apply to future switching.

Check out the company’s history of rate increases. Don’t judge your choice just on the current year. Determine if the company has a history of raising rates for their Medigap clients.

Speak to at least 1 local Medigap insurance agent. Ask how many years they’ve been selling Medicare insurance. Inquire if they are the person you’ll speak to when you have questions.

2023 Medicare Supplement Plan N Price Index

Medicare Supplement Plan N 2023 Price Index PDF

Click to download a PDF or the 2023 Medigap Plan N Price Index.

2023 Price Index Medigap Plan N

Compare Plan N and Plan G – 2023 Price Index

Most seniors turning age 65 pick Plan G. See the price differences.

Click to download a PDF or the 2023 Medigap Plan G Price Index.

2023 Price Index Medicare Supplement Plan G

Get the best Medicare plan for your needs and budget. Ask whether Medicare Advantage or Medicare Supplement (Medigap) is your better option.

Click the link to access the Association’s directory that lists leading Medicare insurance agents and brokers.

Chose the right person and you’ll be satisfied for many years to come. Speak to at least one local agent when shopping for Medicare plan coverage.

Additional Medicare Information Resources

Click on any of the following links to obtain more information.

Medicare Supplement Agents Brokers Find Local Medigap

Find Directory of Independent Medicare Agents Near Me

Latest Medicare Insurance Information Statistics, Data and More

Find the best Medicare insurance plan information from the American Association for Medicare Supplement Insurance.

Do you have questions that aren’t answered here? Call the Association at 818-597-3227. Our goal is providing valuable information that will help seniors make better decisions. We look forward to hearing from you.