Need a Medicare Insurance Agent? Yes, Here's Why & How To Find A Good One

Medicare Insurance Agent: Things To Know

- What is an Agent?

- Is a Broker different?

- How do you find a good one?

- What questions should you ask?

- How do they get paid?

Pick Me, No Pick Me! Lots of People Want To Be Your Medicare Insurance Agent

There is no shortage of people who want to sell you Medicare insurance. That’s a good thing. But every year, a significant percentage of people switch plans (we’ve read statistics as high as 40%). Why were they dissatisfied? Lots of reasons. But, chances are they worked with the wrong Medicare insurance agent.

There is no shortage of people who want to sell you Medicare insurance. That’s a good thing. But every year, a significant percentage of people switch plans (we’ve read statistics as high as 40%). Why were they dissatisfied? Lots of reasons. But, chances are they worked with the wrong Medicare insurance agent.

That’s why the American Association for Medicare Supplement Insurance has posted this page. Because choosing the right person to trust and work with is the first step. It could actually be the most important choice you make.

FULL DISCLOSURE: We offer a directory that lists Medicare agents. It’s free to use and a good place to start. Agents add their listing. We do not evaluate them. But you should and below we share some ways to find the best person to work with.

Do I Need To Work With an Agent?

Yes. Even when you think you are calling directly into an insurance company, you are actually speaking to a licensed insurance agent. The law requires that anyone who offers or sells insurance must be licensed.

Not all agents are created equal. And, that’s an important distinction.

What is an Agent?

As we said, an agent is a licensed professional. Agents have to pass a state examination. They have to take Continuing Education. Also agents must maintain ethical standards. And, they may need more specific training and certification. For example, Medicare insurance agents who offer Medicare Advantage (MA) coverage have additional requirements. That’s why some will sell both MA plans and some will only offer Medicare Supplement (often called Medigap).

Captive

Most agents who are “Captive” can only sell policies from one insurance company. They legal word is “appointed”. You’ll see that references below in our Questions To Ask section. That’s not necessarily a bad thing. The company may have a great plan. But, if that’s all they can sell, they are not going to recommend something else (at least you shouldn’t expect them to).

What is a Broker?

A Medicare insurance broker is also licensed and must meet all the same requirements. He or she can represent multiple insurance companies. They will be “appointed” to sell by each of the companies. Brokers often cannot sell policies from an insurance company that relies on captive agents (with Medicare that’s not always true). Brokers typically will be appointed with a few (not all) companies. See our questions to ask below.

How do you find a good one?

A good place to start is asking your family, friends and neighbors who already are on Medicare. There’s nothing better than a good recommendation. That said, don’t assume they did all the necessary comparisons.

A good place to start is asking your family, friends and neighbors who already are on Medicare. There’s nothing better than a good recommendation. That said, don’t assume they did all the necessary comparisons.

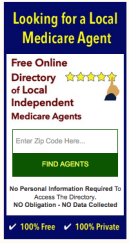

The Association created the online directory because so many consumers called looking for someone in their immediate area. Use the directory to find a Medicare insurance agent in your area.

When you enter your Zip Code (that’s the only info you’ll be asked to enter) you will see a listing. Each agent gets to share a little of what they do (Medicare Advantage, Medicare Supplement, Drug Plans).

This is the only national resource listing local agents who focus on Medicare insurance. It is 100% free to use and 100% private.

What Questions Should You Ask

- How long have you been selling Medicare insurance?

- Are you appointed with only one or with multiple Medicare companies?

- Do you sell Medicare Advantage plans?

- How about Medicare Supplement insurance?

- Can you help me with my Medicare Drug coverage?

- Who do I call when I have questions or need assistance?

Additional Articles Worth Reading

Understand how do Medicare agents get paid by insurers?

How do I choose a Medicare broker, a few tips.

Latest Medicare Supplement prices and statistics.

Seven differences between hybrid long-term care insurance solutions.

Latest long term care insurance statistics and prices.