Comparing Medicare Part D Plans

Comparing Medicare Part D Plans by Jesse Slome, American Association for Medicare Supplement Insurance

July 18, 2024 – 3 Minute Read – Reviewed: AAMSI

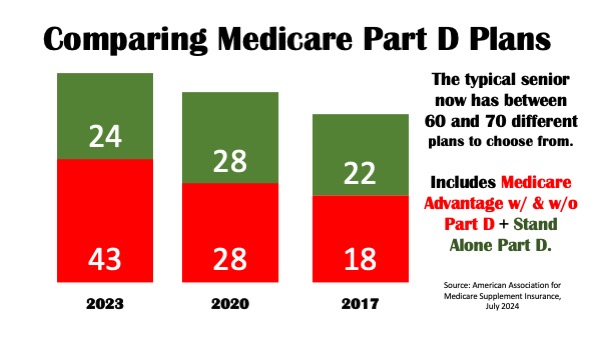

More than 50 million people have Medicare drug plan coverage. There’s lots to choose from. Currently 709 Medicare drug plans available nationally (2024) according to the American Association for Medicare Supplement Insurance (AAMSI). If you are certain that you have the best plan there’s no need to keep reading. But if you are not sure, you are not alone.

Approximately 1.5 million people switched Medicare drug plans in 2023 according to the American Association for Medicare Supplement Insurance. Millions more failed to switch and ending up paying more than they needed to. Here’s food for thought:

- Most people pay an average of $55.50 per month for Medicare Part D drug plans (2024, Source: AAMSI).

- In Dallas and Phoenix, the lowest cost premium for stand-alone Medicare drug plan coverage is $0-monthly (2024, Source: AAMSI).

- The highest premium in 2024 for stand-alone Part D plans in Phoenix is $158.60 monthly. And in Dallas it is $108.30.

- For Medicare Advantage prescription drug plan (MA-PD) enrollees: 10% voluntarily switched plans during the open enrollment period (2020, Source: AAMSI).

- For Medicare beneficiaries enrolled in stand-alone Part D prescription drug plans: 18% switched to another PDP and 3% switched to a MA-PD for coverage (2020, Source: AAMSI).

Comparing Medicare Part D Plans To Save

The typical senior can save between $400 and $1,100 yearly by comparing and switching to a better Medicare prescription drug plan reports the American Association for Medicare Supplement Insurance (2024 estimate).

Some will save by switching to a Medicare Advantage plan providing optimal coverage for their prescription drugs.

Others with stand-alone Medicare drug plans will save by switching to a plan with lower monthly costs and/or better tiers for their prescription drugs.

What Are The Best Way to Compare Medicare Drug Plans?

The best way to compare Medicare drug plans is to follow these steps:

- Identify Your Priorities: Determine what matters most to you, such as specific drugs coverage, protection from high costs, balanced expenses throughout the year, preference for generic prescriptions, or coverage for peace of mind.

- Research Plans: Look for drug plans that align with your priorities. Firstly, check if they include the specific prescription drugs you take as part of their ‘formulary’. Secondly, do they offer low copayments for generics, have low monthly premiums. Plus, provide additional coverage in the coverage gap. Lastly what are the copayments and any deductibles you’ll need to meet.

- Use Comprehensive Online Comparison Tools: The best will allow you to enter your specific drugs and preferred pharmacy. Or, you can seek help from a local Medicare insurance advisor. Many will help by using the very same software on your behalf. During Medicare Open Enrollment (October 15 – December 7) they get very busy. So, don’t wait until the last minute to contact them.

- Consider Extra Benefits: If you prefer integrated health and prescription drug coverage, explore Medicare Advantage Plans (Part C) that include prescription drug coverage.

- Check Ratings and Member Satisfaction: Look into quality ratings and member satisfaction scores of different plans to gauge their overall performance and customer experience.

- Review Restrictions: If you are considering a plan with restrictions on healthcare providers, ensure that the limitations are acceptable to you.

Who Are The Largest Medicare drug plan Providers?

The following are the better known drug plan providers according to the American Association for Medicare Supplement Insurance (AAMSI)

- Humana

- UnitedHealthcare

- Cigna

- WellCare

- SilverScript (part of CVS Health)

- Aetna

- Express Scripts Medicare

- Symphonix Health Insurance (part of Anthem)

- EnvisionRxPlus (part of Rite Aid)

- First Health Part D

Humana is one of the largest Medicare stand-alone drug plan providers, offering comprehensive coverage for prescription medications through its various Part D plans. It is known for providing additional drug coverage during the coverage gap phase and has a strong financial rating.

Aetna is another major player in the Medicare stand-alone drug plan market, excelling in low costs and value for beneficiaries. Aetna’s SilverScript Plus plan provides additional coverage during the Medicare donut hole phase, making it a popular choice among Medicare beneficiaries.

Cigna is also a significant provider of Medicare stand-alone drug plans, known for offering plans with $0 copays and catering to individuals looking for affordable options with good coverage.

3 Tips for Switching Medicare Drug Plans During Open Enrollment

The annual Medicare open enrollment period is October 15 – December 7. Here are important tips to take advantage of this special opportunity.

During the Annual Enrollment Period (AEP), all Medicare beneficiaries have the opportunity to review and make changes to their Medicare coverage. This includes switching to a new Medicare drug plan if desired. Outside of the AEP, individuals can typically only change their Medicare drug plan under certain circumstances, such as qualifying for a Special Enrollment Period due to specific life events like moving to a new location outside their current plan’s service area.

- Review Your Current Coverage: Before switching Medicare drug plans during open enrollment, it’s essential to review your current coverage. Watch for information mailed to you. Make a list of the medications you take regularly, note any changes in your health needs, and assess how well your current plan meets those needs.

- Compare Plans: Take the time to compare different Medicare drug plans available in your area. Look at factors such as monthly premiums, annual deductibles, copayments or coinsurance amounts, coverage for your specific medications, and the pharmacies included in each plan’s network.

- Use Online Tools: Utilize online tools. These tools can help you compare plans side by side based on your specific medication needs and location.

4 More Tips For Medicare’s Annual Enrollment (October 15 – December 7)

- Consider Total Costs: When comparing plans, don’t just focus on the monthly premium. Consider the total out-of-pocket costs for the year, including deductibles, copays, and coinsurance. A plan with a lower premium may end up costing more if it has higher out-of-pocket expenses.

- Check Star Ratings: Pay attention to the star ratings of different Medicare drug plans. These ratings provide an indication of the quality and performance of each plan based on factors like customer service, member satisfaction, and patient safety.

- Don’t Delay: Open enrollment periods have specific deadlines, so make sure to switch plans promptly once you’ve made your decision. This ensures that your new coverage will be effective when needed without any gaps in prescription drug coverage.

- Understand Special Enrollment Periods: Be aware of any special enrollment periods that may apply to your situation outside of the standard open enrollment period. Life events such as moving or losing other coverage can trigger special opportunities to switch Medicare drug plans.

Medicare Insurance Information Statistics Resources

Access relevant Medicare insurance statistics and information using these links.

Another key report to check is the 2024 Medicare Supplement Price Index – PLAN G. See the lowest and highest premium rates for top-10 U.S. markets.

Secondly compare PLAN N Price Index rates. Lowest and highest rates for top-10 U.S. cities.

Especially research ways to find the best Medicare insurance plan.

Likewise valuable info is our Medicare Supplement insurance statistics – what plans people turning age 65 choose.

Lastly find best long-term care insurance costs – free insurance quotes.

The American Association for Medicare Supplement Insurance (AAMSI) is an organization established in 1999 with the primary goal of enhancing consumer understanding of Medicare Supplement (Medigap) Insurance. AAMSI also aims to support insurance professionals who market Medicare insurance solutions. The association does not directly sell or market Medicare Supplement insurance products but provides valuable resources and information to consumers and insurance agents in the industry.

Jesse Slome, the founder of AAMSI, serves as the director. He has also been involved in establishing other insurance organizations focused on long-term care insurance and critical illness insurance.

A key initiative of AAMSI is maintaining the nation’s premier independent online directory of local Medicare insurance agents, known as the Medicare Supplement Find An Agent online directory. This directory is a free service for consumers where insurance agents pay a nominal fee to be listed. It is important to note that AAMSI does not screen, vet, or endorse any agents listed on the directory. Consumers are advised to ensure that they work with properly licensed insurance professionals and carefully review all information provided.