Cost Study Reveals Importance Of Shopping For Medicare Supplement Insurance

Find An Agent

Search your ZIP code to find trusted Medicare agents near you.

Trusted by Thousands of Seniors Nationwide

Medicare Supplement cost analysis 2018

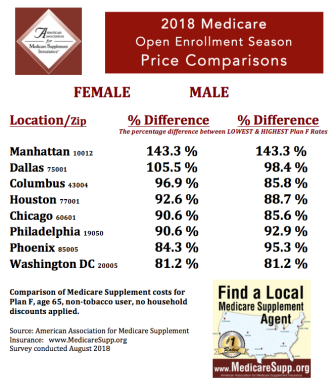

Los Angeles, CA – August 7, 2018: Individuals can pay as much as 143 percent more for virtually identical Medicare Supplement insurance protection according to a cost analysis by the American Association for Medicare Supplement Insurance.

“While Medicare Supplement insurance policies are basically standardized, each insurer sets their own rates and the difference between the lowest and highest cost can be significant,” explains Jesse Slome, director of the Association. The organization compared rates for both men and women age 65 who live in 15 of the latest U.S. markets.

The largest difference between the lowest available cost and the highest could be found in Manhattan (New York City). “The difference was 143.3 percent,” Slome shares. The smallest difference was 12.9 percent for a 65-year old woman purchasing coverage in Jacksonville, Florida.

Click To See Top-15 U.S. Markets 2018 Med Supp

Click this link to see the listing of top-15 cities and the percentage difference between the lowest cost and the highest cost for a 65-year old Plan F Medigap policy.

“There are many factors that insurers use to set policy costs, including costs for medical services and even State requirements,” Slome noted. “For example, a male in Washington, D.C. could pay $122.80-per-month for a Medigap Plan F policy, while a male in Manhattan could pay $482.32 monthly.”

Find Local Medicare Agents For Cost Comparisons

The organization provides free access to the leading national Find A Local Medicare Insurance Agent online directory providing information on nearly 1,000 professionals listed by Zip Code. No information need be entered to access the director at the Association’s website, www.MedicareSupp.org/find-local-agents/.

The American Association for Medicare Supplement Insurance advocates for the importance of planning and supports insurance professionals who market Medicare-related insurance products. The organization’s website contains relevant research and information designed to help consumers make educated choices in their planning.

Our Agents Represent