Best Costs Medigap 2024 – Plan G

Looking for the best costs Medigap 2024? Here are the findings from the Association’s national survey of Medicare Supplement costs for 2024. Here are some key findings from the Association’s 2024 Medigap Price Index:

Looking for the best costs Medigap 2024? Here are the findings from the Association’s national survey of Medicare Supplement costs for 2024. Here are some key findings from the Association’s 2024 Medigap Price Index:

- Medigap Plan G is the most popular choice among men and women turning age 65.

- Women often will pay less than men for Plan G.

- 2024 rates increased in 23 comparisons (vs. 2023).

- Rates decreased in 17 comparisons (vs. 2023).

- Lowest rates for men/women turning 65 — Phoenix.

- Highest rates were for Manhattan (NYC) where a man or woman (age 65) could pay $526.85 monthly.

- Lowest Rate for Male (65) in Phoenix: $110.14 / Highest $458.94

- No single insurer always had the lowest cost policy.

- Neither was one insurer consistently the most expensive.

- As many as 20 Medigap plans may be offered in some areas.

- Discounts of up to 15% can be available for households/roommates.

The complete 2024 Medigap Price Index is posted below.

How To Find The Best Medicare Insurance Plan

Medicare in National. But Medigap and Medicare Advantage plans are Local. Rates will vary by where you live. Therefore, we believe there is great value in working with someone who really knows the specific plans available in your specific Zip Code.

When it comes to Medigap (Medicare Supplement) in some cities there are only a few Medigap plans being offered. For example, in New York City, there are plans offered by 4 insurers. But, in other areas you can have plans from 20 different insurers.

Prices vary significantly as you can see. We compared Medigap Plan G. All Medigap Plan Gs are basically identical. Pick the wrong company and you can easily pay 2x as much as needed.

That’s why we strongly recommend consumers speak with a local Medicare agent. Below the Price Index data, we share some questions to ask them. They are important (and helpful).

Use the Association’s free online directory to find Medicare agents in your area. Not agents with toll free numbers. Medicare agents who live and work near you. It’s free and 100% private. You see their info and decide who (if anyone) you want to call. Click the link to access the Medicare Agent Directory.

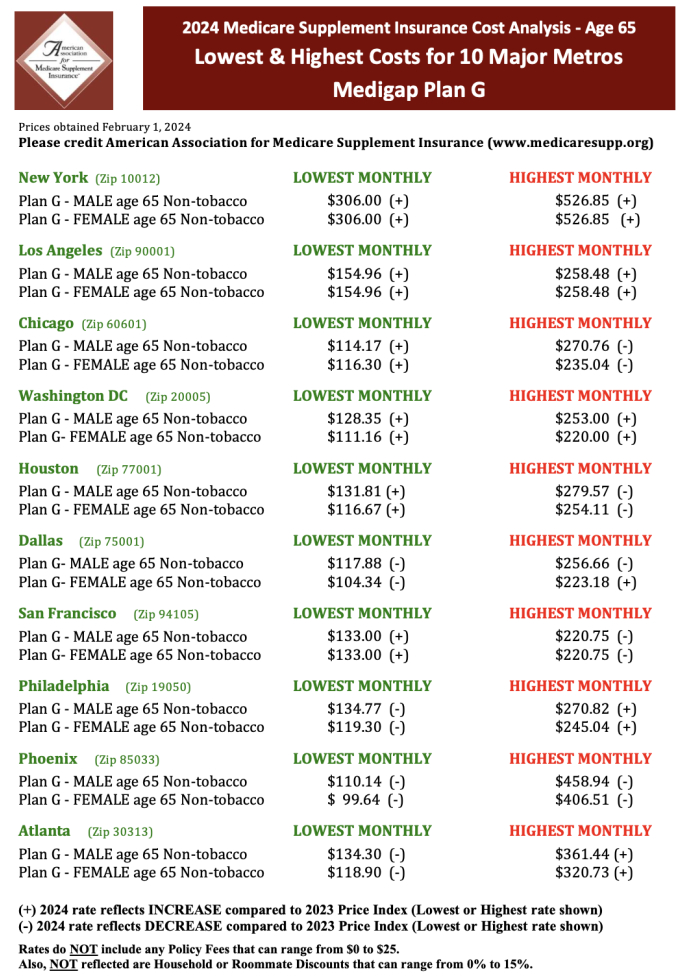

Medigap Plan G Costs 2024 – Top-10 Metro Markets

Here is the 2024 report showing the LOWEST available premium and the HIGHEST for either a man or woman turning age 65. The + sign indicates the 2024 rates are HIGHER than the respective 2023 rate. The – sign indicates the rate is lower than that reported a year earlier.

See the 2023 Medicare Supplement Price Index data (Plan G). Click the link.

Download a PDF of the 2024 Price Index

Click the link to open a PDF of the 2024 Medicare Supplement Plan G Prices

Questions To Ask The Medicare Agent You Speak With

Medicare Supplement (Medigap) policies are generally identical. A Plan G is a Plan G. A Plan G is, however, different than a Plan N. But not all Medicare insurance agents are the same.

Here’s some information we hope will help you ask the right questions to any agent you are speaking with. And, we explain (briefly) why we believe these are important questions to ask.

How long have you been ‘licensed’ to sell Medicare insurance?

When it comes to Medicare insurance, Experience Matters. Experience does help and, at the very least, you should know how long the person you are speaking with has been licensed to sell. New agents may work harder for you and so don’t automatically hang up on someone new. But, it’s a good way to start a conversation with someone you don’t know.

Where are you located?

Almost all Medicare insurance sales today are made over the phone and/or Internet. There can be a benefit to working with an agent located near you. He or she should have a better lay of the land. An agent in a Call Center can be very helpful. They may actually have more plans available. OR, they may be pushing a particular plan. An educated buyer will ask questions to determine who best to work with.

How many different insurance companies you are ‘appointed’ with?

Appointed is insurance industry jargon. It means the insurance agent can actually sell you a policy from that specific company. An agent can only sell and get paid a commission from an insurance company they are appointed with. Some agents are appointed with just one insurance company. Others (typically called brokers) are appointed with multiple companies. One is not better than the other – but it’s something you should know. You want an agent who has your interests at heart.

Which Medicare insurance companies are you appointed with?

Get the agent to name names! You won’t find a broker appointed with all Medicare insurance companies. Especially if there are 20 different companies offering policies in your area. But, let them tell you which companies they are appointed with. If a key name is missing you might want to also get a second option from someone else. Key names include UnitedHealthcare, Aetna, Mutual of Omaha and Blue Cross / Blue Shields. But there are many more. For example, Allstate has started selling Medigap over the past year or two.

Are discounts available? How do they work?

Insurers MAY offer discounts. These discounts can range from 0% to 15%. For a couple, the potential savings is 30%. The most common discount is when multiple family members are covered. It’s NOT likely that you and a spouse will BOTH turn 65 at the same time. Ask what discounts are available and how they work. Will the discount be applied to BOTH policies when the second spouse, partner or roommate applies for coverage?

What is the company’s history of rate increases?

Insurance companies can raise rates. And, they do. Good agents will be able to tell you a company’s history of rate increases. This is important especially with Medicare Supplement (Medigap). Because you may not be able to switch insurers in future years if something has impacted your health.

Do I call you with future questions or issues?

Typically you’ll deal directly with the insurance company. But many seniors tell us that they like speaking to the agent who sold them the original policy. A local Medicare agent with a local office will want to keep in touch. When you are happy, you’ll be a source of future referrals. But, even when speaking to a Call Center, they want you to be happy. Make sure you write down their customer service number.

Find Medigap Plan G Costs 2024 – Local Medicare Insurance Agents

Find local Medicare insurance agents located right in your community. The Association’s free online directory lists agents looking to help you find the best coverage. You can call them. Or, send them an Email and ask them to connect with you.

Plan G Costs 2024 Questions?

If you have more questions, please feel free to reach out to the Association by phone or email. Thank you for taking the time to read this information.