Medigap Plans: Turning 65 Seniors Increasingly Favor Lower Cost Options

Find An Agent

Search your ZIP code to find trusted Medicare agents near you.

Trusted by Thousands of Seniors Nationwide

When it comes to choosing Medicare Supplement plan options, new-to-Medicare beneficiaries are opting for lower cost plans according to the American Association for Medicare Supplement Insurance (AAMSI).

“Some 11,000 Americans turn 65 every day and become eligible for Medicare,” explains Jesse Slome, AAMSI’s director. “Medicare Supplement, or Medigap, remains a highly popular choice but there appears to be greater interest in lower cost options.”

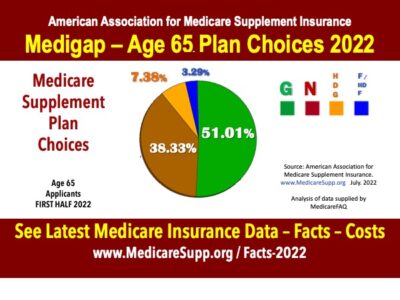

During the first six months of 2022, some 38 percent opted for Medigap Plan N. Just over half (51%) selected Plan G coverage. Nearly six percent enrolled in a High Deductible Plan G (HDG) plan.

During the first six months of 2022, some 38 percent opted for Medigap Plan N. Just over half (51%) selected Plan G coverage. Nearly six percent enrolled in a High Deductible Plan G (HDG) plan.

The Association’s report examining 2021 new enrollees reported that 36.5 percent Plan N, 55 percent selected Plan G, and 6.7 percent High Deductible Plan G.

“I expect the trend to lower cost options will continue for two reasons,” Slome predicts. “First, consumers are being bombarded with Medicare-focused television ads touting free coverage and benefits making it harder to sell coverage that costs. Second, saving money is always a winner with many seniors who live on fixed or limited budgets.”

Medigap Plans – Examples of Cost For G, N and HDG

A Chicago-area female turning 65 can expect to pay $117 monthly for Plan G from a popular Medigap insurer. The same insurer offers Plan N for $86-per-month, amounting to a $372 annual savings. A Medigap HDG plan can be obtained for as little as $32 to $45-per-month. In Chicago, men can expect to pay more for similar coverage. Around $132-per-month for Plan G, $97 for Plan N and between $37 and $48 for HDG.

Plan G covers 100% of all Medicare-covered expenses once your Medicare Part B deductible has been met for the year. First introduced in 2010 as a way to offer lower cost options, Plan N has a few additional out-of-pocket expenses that policyholders will have to pay. These can include a nominal copay for doctor or emergency room visits. Plan N can also have one facing Excess Charges.

High Deductible Plan G is a relatively new option for Medicare beneficiaries. It is only available to those who turned 65 or went on Medicare on or after January 1, 2020. The plan comes with a high deductible ($2,490 for 2022) but is highly appealing for those looking to save money and who may not anticipate many medical needs during the year.

The 2022 survey of over 3,000 new-to-Medicare enrollees selecting Medigap plan coverage was conducted for AAMSI by MedicareFAQ.com a leading national provider of Medicare insurance plans for consumers nationwide.

The American Association for Medicare Supplement Insurance advocates for the importance of insurance protection. To access the latest Medicare insurance statistics, go to www.medicaresupp.org/facts-2022. AAMSI makes available a no-cost national online directory listing local Medicare insurance agents. The directory can be accessed via the organization’s website.

Our Agents Represent